FOREIGN DIRECT INVESTMENT

Foreign investment comes into India in various forms. Following the reforms path, the Reserve Bank has liberalized the provisions relating to such investments.

The Reserve Bank has permitted foreign investment in almost all sectors, with a few exceptions. Foreign companies are permitted to set up 100 per cent subsidiaries in India. In many sectors, no prior approval from the Government or the Reserve Bank is required for non-residents investing in India.

All foreign investment through any of the channels are required to be reported to RBI under FEMA, 1999.

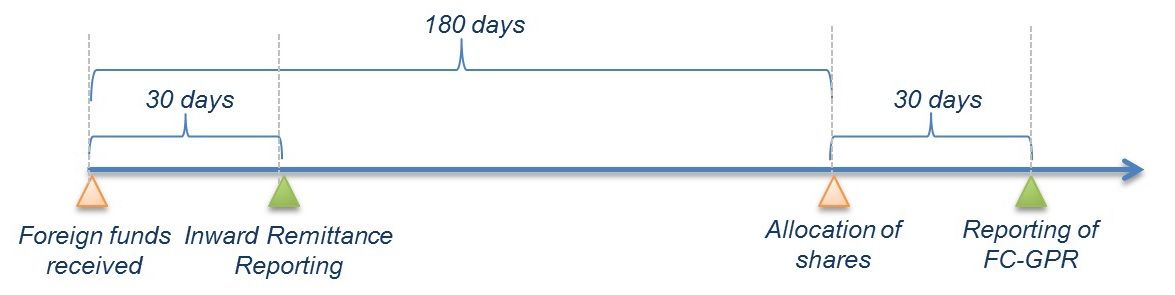

An Indian company which has received amount of consideration for issue of capital instruments and where such issue is reckoned as Foreign Direct Investment for the purpose of these regulations, shall report such receipt (including each upfront/ call payment) in ARF to the Regional Office concerned of the Reserve Bank, not later than 30 days from the date of receipt.

An Indian company issuing capital instruments to a person resident outside India and where such issue is reckoned as Foreign Direct Investment, has to issue the same within 60 days from the date of receipt of amount of consideration and shall report such issue in Form FC-GPR to the Regional Office concerned of the Reserve Bank under whose jurisdiction the Registered office of the company operates, not later than thirty days from the date of issue of capital instruments. Issue of ‘participating interest/ rights’ in oil fields shall be reported in Form FC-GPR.